Victor Ville Bankruptcy Attorney

Losing your job or having no or little health insurance and facing t

housands of dollars in medical expenses can be devastating. You might even be sued for thousands or millions of dollars from an accident or a business decision that was ill-advised. In situations like these, you should consult with a Victorville bankruptcy attorney.

There are different types of filings that a Victorville bankruptcy attorney can counsel you on depending upon the nature and amount of your debts and your goals. Chapter 7 can ease your burden by ridding you of unsecured debt. A Chapter 13 can help a small business stay in business, or allow a debtor with valuable non-exempt property from losing it. It can even help homeowners facing foreclosure or those who are in arrears in child support or alimony.

Chapter 11 is for corporations, partnerships and other businesses who wish to restructure and find their way back to viability. A Victorville bankruptcy attorney can advise you on this any other type of bankruptcy filing that fits your needs.

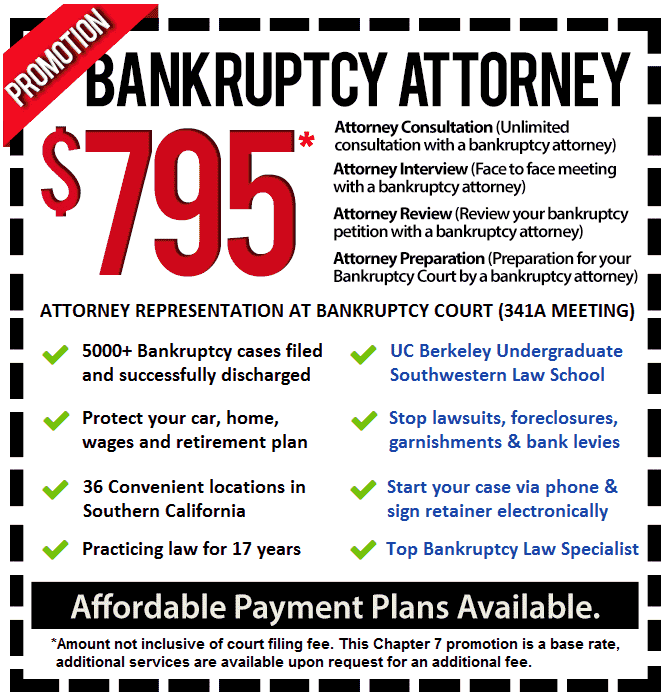

Call a Victorville bankruptcy attorney today at 760-523-8378 for a consultation regarding your financial circumstances.

Chapter 7 Bankruptcy

If you are a Victorville resident who has fallen behind on debt obligations, you are no stranger to repeated phone calls and letters from creditors. In some cases, legal action may have begun that threatens your bank account and other assets. Call a Chapter 7 bankruptcy attorney immediately and find out how a bankruptcy can stop these activities and offer you peace of mind.

Victorville consumers filing Chapter 7 have to qualify based on income and household size that is below the state median. If too high, your Chapter 7 bankruptcy atorney can still determine if your disposable income is not above a set amount. You also cannot file if you filed Chapter 7 in the past 8 years.

If you are eligible, there are other requirements including taking a credit counseling class and providing a payment plan from the class that could possibly pay back creditors over time. If the plan is impractical, then your Chapter 7 bankruptcy attorney will assist you on completing your petition that contains all debts, assets, household expenses and particular transactions over the past 1 to 2 years.

You and your Chapter 7 bankruptcy attorney will have to attend a meeting with the trustee. Any issues that arise will be taken care of by your Victorville bankruptcy lawyer. You can expect a discharge of your unsecured debts such as credit cards and medical expenses within 90 days after your meeting with the trustee. In most cases, debtors retain all of their assets.

Chapter 13 Bankruptcy

A Chapter 13 is for Victorville debtors facing foreclosure or auto repossession, default on a student loan or penalties for alimony or child support arrearages. If you have non-exempt assets you wish to keep, then talk to a Chapter 13 bankruptcy lawyer.

This is a wage earner’s plan that requires you have source of income .Your Chapter 13 bankruptcy lawyer will present a repayment plan over a 3 or 5 year period that first pays secured creditors with priority, such as employees and spouses owed support, before unsecured ones. There are limits on how much you can have but a Chapter 13 bankruptcy lawyer can strategize to get you under them if necessary. Mortgage and auto payments arrearages can be included as well.

Talk to a Chapter 13 bankruptcy lawyer about the benefits of a Chapter 13.

Chapter 11 Bankruptcy

Victorville corporations, LLCs and partnerships can file Chapter 11 when facing insurmountable debt. A Chapter 11 bankruptcy attorney will prepare a reorganization plan that is feasible, proposed in good faith, benefits creditors and is fair and equitable. Creditors have to confirm the plan or offer their own in some cases. If confirmed, the business owners or officers can, under the aegis of the court, break and negotiate new leases and contracts, modify others and shut down some operations or expand others.

Small businesses can fast track the system with the help of a Chapter 11 bankruptcy attorney that is less cumbersome and more affordable. Individuals who cannot file Chapter 7 or 11 and have large debt may also file Chapter 11.

Bankruptcy is a legal process that a Victorville bankruptcy lawyer should handle for you, regardless if it appears uncomplicated. Call a Victorville bankruptcy lawyer at 760-523-8378 to see how you can get started on the path to a new start.