Barstow Bankruptcy Attorney

Barstow Bankruptcy Attorney

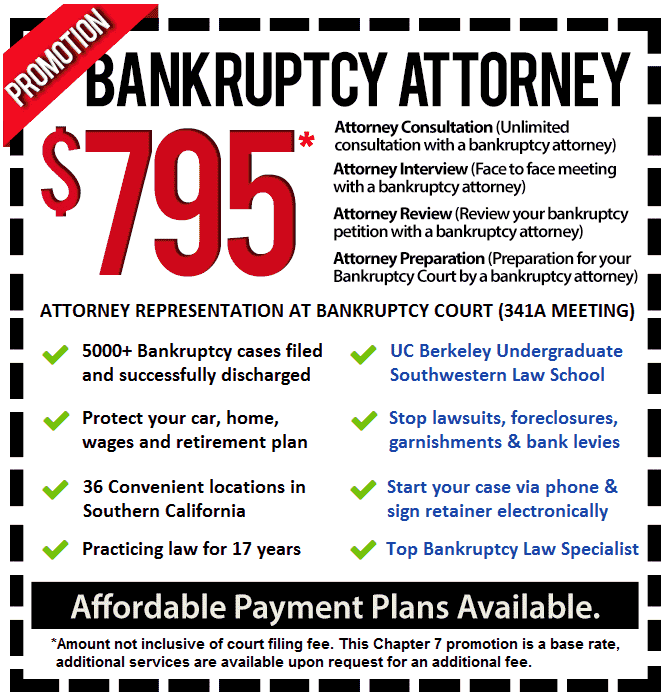

Barstow residents and business owners can seek the advice of a Barstow bankruptcy lawyer if they are experiencing financial difficulties. Depending on your situation, a bankruptcy might be the best option for your situation that can wipe out chronic debt, save your home or business and get you a fresh start. Call a Barstow bankruptcy lawyer at 760-498-3994 to discuss how a bankruptcy can help.

Filing for bankruptcy requires that you have sound advice from a Barstow bankruptcy attorney who can explain the eligibility requirements for a Chapter 7 and 13, what debts are secured or have priority and what assets may be retained. If you are facing foreclosure or loss of your car, Chapter 13 might be your answer. For corporations and large businesses seeking to get back to profitable status, a Chapter 11 can be used to reorganize your business. In all bankruptcies, an automatic stay goes into immediate effect so that all legal actions including phone calls as well as collection and foreclosure activities must cease.

Your Barstow bankruptcy lawyer can handle these types of bankruptcy filings:

Chapter 7 Bankruptcy

Barstow residents who are consumers, business owners or corporate officers can seek Chapter 7 relief after discussing their situation with a Barstow  bankruptcy attorney. This process wipes out unsecured debt. The automatic stay provision ceases all creditor activity including lawsuits and seizure of assets.

bankruptcy attorney. This process wipes out unsecured debt. The automatic stay provision ceases all creditor activity including lawsuits and seizure of assets.

Individuals with primarily consumer debt must pass an eligibility test whereby their income cannot exceed the state median income for that household size. If you cannot meet the test, your Chapter 7 bankruptcy lawyer can assess whether your disposable income is below a certain amount so you can qualify.

A Chapter 7 bankruptcy lawyer can also review your list of debts, assets, transactions over the past year and household expenses as well as how the exemptions list can help you retain your personal assets. Sometimes non-exempt assets can be converted to exempt with the efforts of a Barstow bankruptcy attorney.

You do have to attend two meetings–a debtor education class before filing and a financial management one before discharge. Both can be held at the office of your Chapter 7 bankruptcy lawyer. Usually, you will only need to attend a brief meeting with the trustee on your case to confirm some facts in your petition. Your Chapter 7 bankruptcy lawyer can review this with you. Discharge of your case usually takes about 4 months from date of filing.

Chapter 13 Bankruptcy

Sole proprietorships and partnerships wishing to stay operational while repaying their creditors over time can file for Chapter 13. Homeowners risking their homes to foreclosures or their vehicles to repossession can benefit as well. Your Chapter 13 bankruptcy lawyer will examine your expenses and draft a repayment plan that can include mortgage or car loan arrearages to be paid over a 36 or 60-month period. You will need to keep payments current as well as your Chapter 13 bankruptcy lawyer will so advise you.

Those Barstow debtors who are otherwise ineligible to file for Chapter 7 or who stand to lose non-exempt property like second vehicles, vacation homes or boats can use Chapter 13 to retain these assets.

If filing for Chapter 13, you need a proven source of income and pass the same means test as required for Chapter 7 filers. There are debt limits for secured debt and unsecured debt. Even if your debts exceed these limits, your Chapter 13 bankruptcy lawyer can use methods to get them below the limits.

Discuss the benefits of this type of filing with a Chapter 13 bankruptcy attorney.

Chapter 11 Bankruptcy

An experienced Barstow bankruptcy attorney is needed to handle the complexities of a Chapter 11. This process is generally for corporate entities although small businesses can utilize Chapter 7 as can individuals with large debts with the help of a Chapter 11 lawyer. It involves a restructuring that often entails downsizing the company, re-doing contract and leases and finding sources of revenue. Creditors can also force a company into Chapter 11 by filing an involuntary petition. After filing, a Chapter 11 lawyer files a repayment plan that provides a strategy for getting the business back to profitability.

Creditors have to approve the plan or submit their own for approval or have the court force one on them in some cases. The repayment plan generally means creditors are paid less than what is owed them. For small businesses in Barstow, a Barstow bankruptcy lawyer can explain the fast track system that bypasses many of the formalities.

The business is overseen by a trustee who monitors the operations and determines if the operation has an opportunity to become profitable or it may go to Chapter 7.

Bankruptcy can be a viable option for individuals and businesses to use to get a fresh start in life and in business. Call a Barstow bankruptcy attorney at 760-498-3994 to see if it is right for you.